Blockchain technology is often associated with cryptocurrencies, but its potential goes far beyond digital currencies. In recent years, it has gained attention as a game-changer in industries like finance, supply chain management, and healthcare. One area where blockchain is beginning to make waves is real estate. The real estate industry, traditionally slow to adopt new technology, is exploring blockchain’s potential to streamline transactions, increase transparency, and reduce costs. This article explores the role of blockchain in real estate transactions, its benefits, challenges, and what the future may hold.

What is Blockchain?

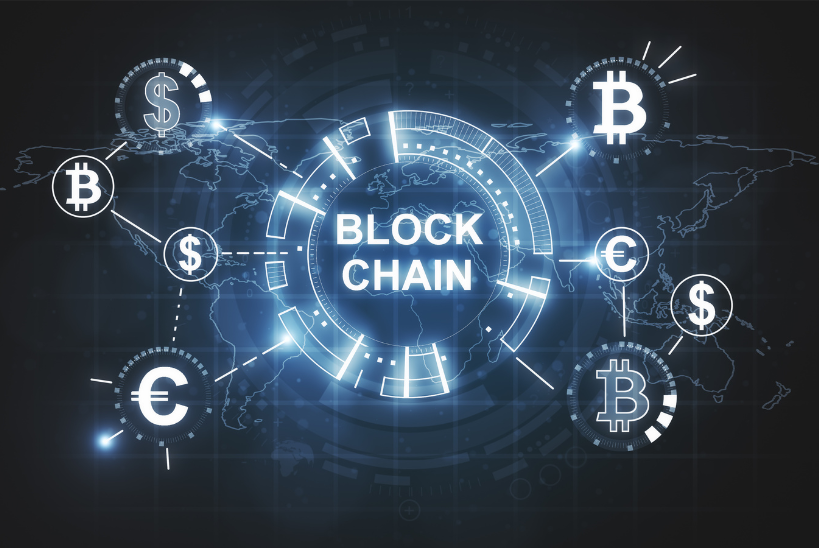

Before diving into its real estate applications, it’s important to understand what blockchain is. In simple terms, blockchain is a decentralized, digital ledger that records transactions across multiple computers in a way that ensures data integrity and security. Each transaction is stored in a “block,” and once a block is complete, it is added to a chain of previous blocks, forming a “blockchain.” This technology is resistant to tampering and fraud because every transaction must be validated by the network, making it nearly impossible to alter information retroactively.

How Blockchain Applies to Real Estate

Real estate transactions involve numerous parties, complex processes, and a significant amount of paperwork. From title searches and deed transfers to escrow and mortgage agreements, the traditional system is laden with inefficiencies. Blockchain aims to address these pain points by offering a more secure, transparent, and efficient method for managing real estate transactions.

1. Smart Contracts

One of the most promising applications of blockchain in real estate is the use of smart contracts. Smart contracts are self-executing contracts with the terms of the agreement directly written into code. They automatically execute transactions when predefined conditions are met. For example, in a real estate transaction, a smart contract could release funds to the seller as soon as the buyer confirms receipt of the property title. This eliminates the need for intermediaries like lawyers and escrow agents, reducing costs and speeding up the transaction process.

2. Tokenization of Real Estate Assets

Blockchain allows for the tokenization of real estate assets, which essentially means dividing ownership of a property into digital tokens. These tokens can be traded on a blockchain platform, making it easier for individuals to invest in real estate. Instead of purchasing an entire property, investors can buy fractional ownership, allowing for greater liquidity in an otherwise illiquid market. This democratizes real estate investing by lowering the barriers to entry and providing access to a broader range of investors.

3. Improved Title Management

Title management is one of the most challenging aspects of real estate transactions. Verifying ownership and ensuring that a property is free of liens or disputes can be a time-consuming and costly process. Blockchain can simplify title management by providing a single, immutable record of ownership. Every change in ownership is recorded on the blockchain, reducing the risk of fraud, human error, and disputes. This makes the title transfer process faster and more secure.

4. Transparent and Immutable Records

Blockchain’s inherent transparency and immutability make it ideal for recording real estate transactions. Once data is recorded on the blockchain, it cannot be altered or deleted. This creates a trustworthy, auditable history of transactions that is accessible to all parties involved. This transparency reduces the likelihood of fraud and builds confidence among buyers, sellers, and regulators.

The Benefits of Blockchain in Real Estate

Blockchain technology offers several key advantages in real estate transactions:

- Efficiency: By automating processes like contract execution and title verification, blockchain can significantly speed up real estate transactions. Tasks that once took weeks or even months can be completed in a matter of days.

- Cost Savings: Blockchain reduces the need for intermediaries such as brokers, escrow agents, and lawyers, leading to lower transaction costs.

- Transparency: All parties involved in a transaction can access a shared, tamper-proof ledger, which increases trust and reduces the risk of disputes.

- Security: Blockchain’s decentralized nature and cryptographic features make it extremely difficult to tamper with or hack, providing a higher level of security compared to traditional systems.

- Accessibility: Tokenization of real estate assets opens up investment opportunities to a wider audience, allowing more people to participate in real estate markets.

Challenges and Limitations

Despite its potential, blockchain is not without its challenges when it comes to real estate transactions.

- Regulatory Hurdles: The real estate industry is heavily regulated, and the adoption of blockchain requires changes in laws and regulations. Governments and regulatory bodies must establish frameworks that recognize and govern blockchain-based transactions.

- Scalability: Blockchain networks face challenges related to scalability. As more transactions are added to the blockchain, the network can become slower and more expensive to operate. Solving these issues is crucial for widespread adoption.

- Technical Complexity: Implementing blockchain technology requires significant technical expertise. Many real estate professionals lack the knowledge or resources to integrate blockchain into their operations.

- Market Acceptance: While blockchain is gaining traction, many stakeholders in the real estate industry remain hesitant to adopt it. Widespread adoption will require education, trust-building, and overcoming resistance to change.

Real-World Examples of Blockchain in Real Estate

Several companies and projects are already leveraging blockchain technology to transform real estate transactions:

- Propy: Propy is a blockchain-based platform that facilitates cross-border real estate transactions. It enables users to buy and sell properties online using smart contracts, streamlining the process and reducing the need for intermediaries.

- RealT: RealT tokenizes real estate properties, allowing investors to purchase fractional ownership in properties using blockchain technology. Investors receive rental income proportionate to their ownership stake, which is distributed through blockchain-based payments.

- Ubitquity: Ubitquity offers a blockchain-powered platform for recording, tracking, and transferring real estate titles. It provides a secure, immutable ledger that simplifies title management and reduces the risk of disputes.

The Future of Blockchain in Real Estate

Blockchain has the potential to revolutionize real estate transactions, but its full adoption will take time. As more companies and governments explore its benefits, we can expect to see an increase in blockchain-based real estate platforms and services. However, challenges like regulatory acceptance, scalability, and market readiness must be addressed before blockchain can become a mainstream solution in real estate.

In the coming years, blockchain could lead to a more efficient, transparent, and accessible real estate market. It could also pave the way for new business models, such as decentralized property exchanges and peer-to-peer real estate transactions. While we’re still in the early stages, the real estate industry is on the cusp of a digital transformation, with blockchain at the forefront of this evolution.

Conclusion

Blockchain technology holds immense promise for real estate transactions. From automating contracts and improving title management to enabling fractional ownership and enhancing transparency, blockchain has the potential to address many of the inefficiencies and challenges in the real estate industry. While there are hurdles to overcome, the adoption of blockchain in real estate is steadily growing, and its impact could be transformative. As the technology matures and regulatory frameworks evolve, blockchain could become an integral part of the real estate landscape, benefiting buyers, sellers, and investors alike.